Marshall Financial Solutions

Protecting you - Saving you Time and Money

Relevant Life Cover

Relevant Life – Most group risk providers are reluctant to write schemes for fewer than 5 members, and then only as part of a registered group risk scheme.

The relevant life policy is a single life, stand-alone death-in-service plan, providing benefits on an individual basis.

Key benefits :

- Unique individual stand-alone cover

- Tax advantages for high earners

- Premiums not taxed as a benefit in kind

- Allowable as an expense for the employer

- Cover now up to 20 times annual salary

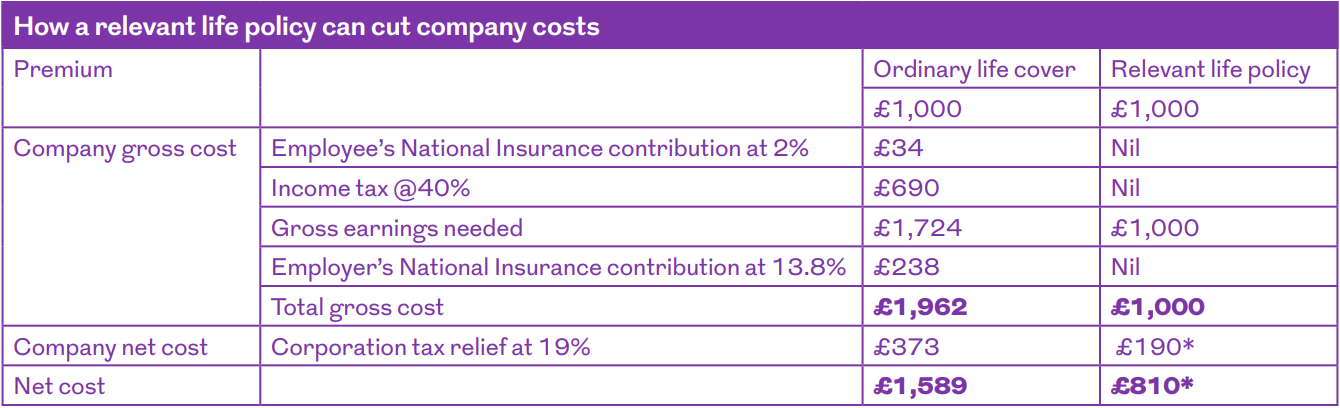

There are various advantages to this. For a start, it offers high-earning employees who have substantial pension funds a number of tax advantages.

That’s because the lump sum benefits do not form part of the employee’s annual or lifetime pension allowance.

And, although the company pays the premiums, they are not normally taxed as a benefit in kind – which can offer huge savings, especially for a higher rate taxpayer.

While it is mainly aimed at high earners, it can be suitable for any employee. What’s more, the payments may also be treated as an allowable expense for the employer in calculating their tax liability.

Which means it is also particularly suitable for small businesses that do not have enough eligible employees to warrant a group life scheme.

Who can have it.

An employer's business which is UK registered, and the employee who is habitually resident in the UK (meaning England, Wales, Scotland, Northern Ireland but not the Isle of Man or the Channel Islands).

Has a UK bank account and is not:

* Under 18

* 74 or older (cover stops at age 75).

The employer will own the policy and the employee will be the person covered but as Relevant Life Cover is written in trust, for the employee’s beneficiaries, the pay-out will go into the trust in the event of a claim.

Table Source : Royal London Marketing Studio

Now that looks like a head start for your business.

Remember, this is based on our understanding of current tax law which could change in the future

![]() The Plan will have no cash in value at any time, and will cease at the end of the term. If premiums are not maintained, then the cover will lapse.

The Plan will have no cash in value at any time, and will cease at the end of the term. If premiums are not maintained, then the cover will lapse.

Other Services

Mortgages

Equity Release

Home and Contents Insuranse

Life Insurance

Related Topics

Keyman Insurance

Relevant Life Cover allows employers to offer a death-in-service benefit to their employees. It's a tax-efficient life insurance policy.

Shareholder Protection

Shareholders acquire shareholder protection insurance because they want to protect their welfare.

Cross Option Agreements

The death of a shareholder who is also a director can have a major impact on any business if the company has not made plans for such an event.